Present value of bond calculator

The algorithm behind this bond price calculator is based on the formula explained in the following rows. The bond valuation calculator follows the steps below.

Bond Yield Calculator

This free online Bond Value Calculator will calculate the expected trading price of a bond given the par value coupon rate market rate interest payments per year and years-to-maturity.

. Find out what your paper savings bonds are worth with our online Calculator. Therefore such a bond costs 79483. Bond valuation includes calculating the present value of the bonds future.

Future value or FV is what money is expected to be worth in the future. Bond valuation is a technique for determining the theoretical fair value of a particular bond. Present Value Paid at Maturity Face Value Market Rate 100 Number Payments Present Value of.

F Facepar value. C Coupon rate. Input these numbers in the present value.

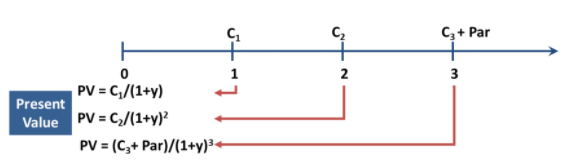

The calculator uses the following formulas to compute the present value of a bond. Bond Value Present value of the face value Present value of the remaining interest payments Bond Valuation Definition Our free online Bond Valuation. The Calculator will price paper bonds of these series.

N Coupon rate compounding freq. It is assumed that all bonds pay interest semi-annually. The face value is the balloon payment a bond investor will receive when the bond matures.

Therefore the present value of the face value of the bond is 74730 which is calculated as 100000 multiplied by the 07473 present value factor. The purpose of this calculator is to provide calculations and details for bond valuation problems. The present value of such a bond results in an outflow from the purchaser of the bond of -79483.

The present value formula is PVFV 1i n where you divide the future value FV by a factor of 1 i for each period between present and future dates. F Face value of the bond r Coupon rate PY Payments a Year E Days elapsed since last payment TP Time between payments from above description. Where r is the discount rate and t is the number of.

If you own or are considering purchasing a US. Go to a present value of. Calculator Results for Redemption Date 092022.

Present Value of a Bond is the value of a bond equal to the discounted remaining interest payments and the discounted redemption value of the bond certificate. Home financial present value calculator Present Value Calculator This present value calculator can be used to calculate the present value of a certain amount of money in the future or. Department of Treasurys Bureau of the Fiscal Service has designed a useful tool for.

PV present value FV future value i interest rate per period in decimal form n number of periods The present value formula PV. EE E I and savings notes. The Present Value Formula P V F V 1 i n Where.

Using the example in the. If you wonder how to calculate the Net Present Value NPV by yourself or using an Excel spreadsheet all you need is the formula. Savings bond the US.

Calculate the value of a paper bond based on the series denomination and issue date entered. Determine the face value. Typically cash in a savings account or a hold.

Related Investment Calculator Present Value Calculator. HOW TO SAVE YOUR INVENTORY. Calculate the Value of Your Paper Savings Bond s The Savings Bond Calculator WILL.

N 1 for.

Learn How To Calculate Bond Price Value Tutorial Definition Formula And Example

Zero Coupon Bond Formula And Calculator

How To Calculate Pv Of A Different Bond Type With Excel

Coupon Bond Formula How To Calculate The Price Of Coupon Bond

How To Calculate Bond Value 6 Steps With Pictures Wikihow

Excel Formula Bond Valuation Example Exceljet

Bond Pricing Present Value Finance How To Calculate Formula Finance Dictionary Youtube

Bond Valuation Calculations For Cfa And Frm Exams Analystprep

Zero Coupon Bond Value Formula With Calculator

How To Calculate Bond Price In Excel

An Introduction To Bonds Bond Valuation Bond Pricing

Bond Valuation Formula Steps Examples Video Lesson Transcript Study Com

How To Calculate Pv Of A Different Bond Type With Excel

Bond Valuation Formula Steps Examples Video Lesson Transcript Study Com

Bond Pricing Formula How To Calculate Bond Price Examples

Bond Valuation A Quick Review Youtube

Yield To Call Ytc Bond Formula And Calculator